14th April 2023

How to set SMART financial goals

Any investing journey starts with setting SMART financial goals. These goals will determine your investment strategy and provide guidance on the best way to build your investment portfolio.

We all have goals we want to achieve, whether that’s buying a house, studying for a master’s, travelling the world or having a child.

What do all these goals have in common?

They’re tightly correlated with money. In fact, there’s always some sort of financial investment to achieve or pursue such things. And that’s fine! We just need to learn how to set SMART financial goals so we can see our desires come to fruition.

And by smart, we don’t mean intelligent, but S-M-A-R-T!

What are SMART financial goals?

SMART goals are a method where goals are outlined using a tested and proven method. According to this methodology, it’s important for goals to be: Specific, Measurable, Achievable, Realistic and Time-bound.

Let’s dive into each of them, why they’re important and how to implement them correctly.

Specific

Sometimes we tend to have vague goals like “I want to improve my quality of life”.

It’s a great goal, but what tends to happen is that months pass by and you look back and you can’t really tell whether you actually improved your quality of life.

That’s why we recommend being specific about what your goal is. So, in this case, it could be something like “I want to be in bed by 10 pm each night”. This helps towards improving your quality of life and is a specific thing you can do, control and track.

Measurable

In order to achieve your SMART financial goal, you need to be able to measure if you’ve reached it or not. This will help you hold yourself accountable and keep track of your progress towards your goal.

Let’s look at a goal of investing £5,000 a year. To achieve this, you could set up a direct deposit of £500 from your monthly paycheck into a separate savings account and reduce your monthly expenses by £200 through budgeting. This goal is measurable because the progress towards it can be tracked by monitoring your investing account balance and the reduction in monthly expenses.

Achievable

To determine if your SMART financial goal is achievable, you need to assess whether it is realistic and attainable within the given timeframe.

Consider the resources, time, and effort required to achieve the goal, and whether you have access to them. For instance, if your goal is to invest £5,000 a year, you’ll need to evaluate if you have a steady income stream, a budget that allows for investing, and if there are any external factors that could impact your ability to invest.

If you realise that the goal is not achievable right now, you can adjust the goal to make it more realistic and attainable, such as increasing the timeline or breaking the goal down into smaller, more manageable steps.

Relevant

To determine whether your SMART financial goal is relevant, you need to assess whether it aligns with your broader financial objectives. Consider whether achieving the goal will help you make progress towards your larger financial aspirations. For example, investing regularly may be your current goal because long term, you want to retire early and live off of your investments.

It’s essential to ensure that your goal is not only achievable but also meaningful to you. If your SMART financial goal is relevant, you will be more motivated to work towards it and ultimately achieve it.

Time-bound

Setting a time frame for achieving your financial goals is crucial to keep yourself accountable and motivated. To ensure that your SMART financial goals are time-bound, you should ask yourself questions like “When do I want to achieve this goal?” and “Is it realistic to achieve this goal in this time frame?” When setting time-bound goals, make sure to be specific and realistic.

For example, if your financial goal is to save £10,000 to start investing in property with Propelle, you could set a time frame of one year to achieve this goal. This allows you to break down your goal into smaller milestones and create a realistic plan to save money consistently over the course of 12 months. Setting a specific time frame also helps to create urgency and accountability, as it gives a clear deadline to work towards.

It’s always good to remember that timelines can be adjusted!

Putting our learning into action

We’ve spoken to many women who’ve struggled to set SMART financial goals. So we’ve built a goal-setting tool within our platform to help you and all the women out there set your goals the SMART way!

It’s a pretty awesome tool, if we do say so ourselves.

If you’re already a Propelle member (you can join for free here), you’ll remember that this was the first step of your sign-up journey. This is because we believe it’s the first step to investing. It also cultivates the right mindset to get started.

If you’re not a member yet, then start setting your goals by registering to Propelle today!

What are the most common financial goals?

Is your mind going blank just thinking about what sort of SMART financial goals you should set?

No sweat!

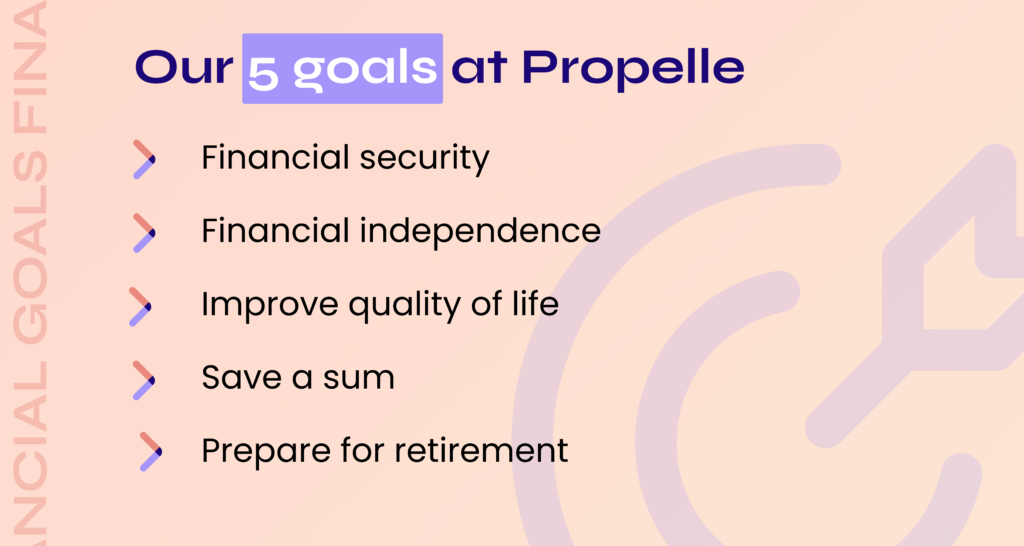

Most of the goals we’ve seen the women in our community set typically fall under the following categories:

Financial independence

Achieving financial independence gives you the ability to support your lifestyle expenses without having to rely on traditional forms of income, such as a job or a paycheck. It means having enough investments and savings to cover all of your living expenses, both now and in the future, without the need for a salary or wages from an employer.

Financial independence also means having the freedom and flexibility to pursue your passions and interests, rather than being tied to a particular job or career path out of financial necessity. Achieving financial independence is often a long-term goal that requires careful planning, budgeting, saving, and investing.

Financial security

Financial security refers to a state where you have enough income and assets to meet your current and future financial obligations and achieve your financial goals without falling into financial distress. Essentially, it means having peace of mind that your financial future is stable and secure.

Financial security can look different for everyone depending on their personal financial goals and circumstances. Generally, it could look like having enough income to cover basic living expenses and unexpected expenses without relying on credit or borrowing money.

For some, it may look like having a solid financial plan in place, such as a budget, emergency fund, and retirement funds. For others, financial security may mean having enough money to travel, pursue hobbies, or support loved ones.

Better quality of life

Who doesn’t want to improve their quality of life? Again, a better quality of life looks different to everyone.

Maybe it’s joining an exclusive gym? Maybe it’s being able to take two trips abroad per year? Maybe you’ve finally made the decision to start learning the piano.

Whatever it is that’s going to make you happier, and improve the quality of your life, it’s valid and a really good goal to work towards. After all, isn’t it all about living to the fullest?

Save a lump sum of money

The simplest and most universal goal is usually needing a specific sum of money for something. Whether it’s a car, a wedding, a master’s degree, a side hustle, a holiday or a down payment for a house. A lot of the things we want need an upfront sum of money before we can have them.

Build a retirement fund

Retirement can feel far away, but it’s important to start to think about it early on. After years of working really hard, you deserve to live the life you want. So planning for retirement should be a priority as soon you’re earning a stable income.

You’ll have to sit down and think about the lifestyle you want to have, the assets you will own and how much you’ll need to pay for them. Think about your mortgage or rent, bills, food, transport, going out, travelling, gifts, shopping etc.

Once you have a clear picture, try and quantify how much that totals in a year. Is it £30k, £70k or even more? Once you have that number, the rule of thumb is to roughly multiply it by 25 to know how much you’ll need in your retirement fund.

Conclusion

In conclusion, setting SMART financial goals is crucial to achieve financial independence and pursue your financial aspirations.

SMART financial goals are specific, measurable, achievable, relevant, and time-bound, and they help you determine your investment strategy and build your investment portfolio. When setting SMART financial goals, it is important to assess the resources, time, effort required, and external factors that could impact your ability to invest. It is also essential to ensure that your goals are meaningful to you and aligned with your broader financial objectives.

At Propelle, a platform we built for women to take actionable steps towards investing, offers a goal-setting tool to help you set SMART financial goals and cultivate the right mindset to get you started on your investing journey.

Propelle does not provide investment advice. If you are unsure about anything, please seek financial advice from an authorised advisor. Your capital is at risk.