11th April 2023

What is Asset Allocation?

Asset allocation is like making a tasty and healthy salad.

What is Asset Allocation?

Imagine you want to make a tasty and healthy salad. You have a choice of different kinds of protein, different kinds of greens, some ingredients to add more taste, and of course some chia seeds to give that super boost. But in order for it to be balanced, you don’t want to use too much or too little of any one ingredient. You need to decide which proteins or greens to include, how much of each to use and in what order to add the ingredients. You might also want to layer your salad with the proteins and greens making up the base and most of it and the rest of the ingredients added in with the seeds on top.

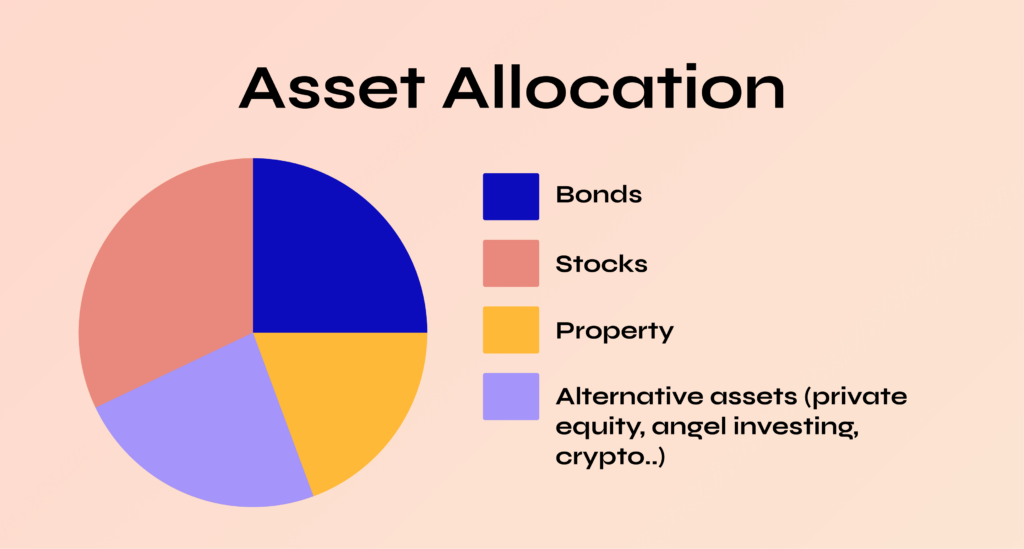

Well, investing works kind of like making a salad. Instead of protein, greens, seeds and dressing, you have different kinds of assets like stocks (equities), bonds, real estate, private equity and so on. And just like with the salad, you want to choose the right amount of each asset to have in your investment portfolio, the order you want to add them and how you want them to be layered (i.e. what will make up the bulk of your portfolio and what will be sprinkled on top for that super boost, or will you just add equal portions of everything.

This process of choosing the right mix of assets is called asset allocation, and it’s really important for investing. Asset allocation helps you diversify your investments (not have all your eggs in one basket), which means spreading your money across different kinds of assets, which have different types of risk and returns. The aim is to get as high a return as possible for as little risk as possible. But given the risk and return are like two different sides of the same coin (i.e. you have to take risk when you seek returns and typically the higher the returns the higher the risk), building a portfolio is a balancing act between the two.

For example, if you only invest in tech stocks and the tech sector performs badly, most, if not all of the companies in the sector may suffer negative performance and so the value of your portfolio may fall. If you had a mix of different types of stocks (eg tech stocks, energy stocks, banking stocks) or better still a mix of different types of stocks and a mix of different asset classes (so a mix of various types of stocks and a mix of various types of bonds and some real estate for example) if any one sector or asset class performs badly it doesn’t mean that your overall portfolio will perform badly. When some assets fall in value, others rise (there are some assets that tend to move together). The way asset classes “move together” (go up or down in value relative to each other) is called correlation.

Correlation: The way assets or investments dance together (or not)

Asset class correlation is like a game of “follow the leader” that happens between different types of investments.

Imagine you have a group of friends who all like to dance. Sometimes, one person will start dancing in a certain way, and then others will start copying their moves. In the same way, when one type of investment (like stocks or bonds) starts to do well, other types of investments tend to follow along and do well too.

On the other hand, if someone in your dance group starts doing a weird dance that no one else can follow, they might end up dancing alone. Similarly, if one type of investment is doing poorly while others are doing well, it might end up isolated from the rest of the group.

Asset class correlation helps investors understand how different types of investments move in relation to each other. By paying attention to this, investors can create a portfolio that includes a mix of assets that are likely to move together in a way that reduces risk and maximizes returns.

If a company goes bankrupt, you could lose all your money. But if you spread your money across different stocks, bonds, and other assets, the risk is spread out too, so you’re less likely to lose everything.

Rebalancing: Anyone fancy a game of Jenga?

Asset allocation rebalancing is like playing a game of Jenga. Just like how you carefully remove and replace blocks to keep the tower stable, investors adjust their portfolios to maintain a balance of different asset classes.

Imagine you’re playing Jenga and you start with a tall, stable tower. However, as you play, some blocks get pulled out more than others, causing the tower to become wobbly and unstable. To keep the tower from toppling over, you carefully remove blocks from the taller parts of the tower and place them on the shorter parts, making the tower more balanced and stable again.

In the same way, investors rebalance their portfolios by adjusting the amounts of each asset class to keep their portfolios in line with their target allocation. If, for example, stocks have performed well and now make up a larger percentage of the portfolio than desired, the investor may sell some stocks and purchase other assets (like bonds) to bring the portfolio back in line with their desired allocation. Rebalancing can be done at various frequencies (daily, monthly, quarterly, yearly etc), but it’s often done quarterly.

Rebalancing helps investors manage risk and maintain a consistent level of risk exposure in their portfolios. It’s like adjusting the Jenga tower to keep it from falling over. By regularly rebalancing your portfolio, you can keep your investments stable and on track to meet your long-term goals.

Summary

You need to be mindful of a few things when it comes to asset allocation.

First, you need to think about your goals – what are you investing for and how much risk can you tolerate? Different asset allocations will have different levels of risk and potential returns. It’s important to choose one that matches your goals and comfort level.

Second, you need to monitor your asset allocation over time. As the value of different assets goes up and down, your portfolio might drift away from your original asset allocation. It’s important to rebalance your portfolio periodically to make sure it stays in line with your goals.

For a detailed breakdown on all asset classes, head to the Courses in the Learn section.

Propelle does not provide investment advice. If you are unsure about anything, please seek financial advice from an authorised advisor. Your capital is at risk.