14th April 2023

Understanding Your Financial Picture: Calculating Your Net Worth

Do you ever feel like you’re lost in a financial fog, with no idea where you stand financially? Or maybe you have a vague idea of what you own and what you owe, but you’re not sure how to put it all together into a clear financial picture? If so, you’re not alone. Many people find it challenging to understand their financial situation, but calculating your net worth can help bring clarity and focus to your financial goals.

What is Net Worth?

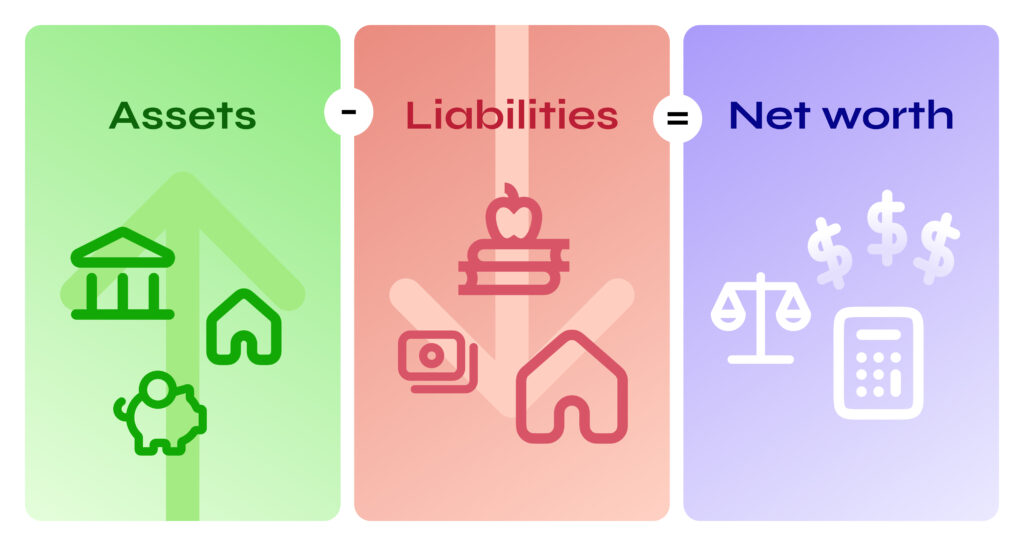

Net worth is a term used to describe the value of everything you own (your assets) minus everything you owe (your liabilities). Essentially, it’s the amount of money you would have left over if you sold everything you own and paid off all your debts.

Why is Net Worth Important?

Your net worth is an important financial metric that can help you understand your financial situation and make informed financial decisions. Here are some reasons why calculating your net worth is important:

- It gives you a clear picture of your financial situation: By calculating your net worth, you can see how much you own and how much you owe, giving you a clear picture of your overall financial health.

- It helps you track your progress: Your net worth can serve as a benchmark for tracking your financial progress over time. As you pay off debts and accumulate assets, your net worth should increase, providing a sense of accomplishment and motivation to keep working towards your financial goals.

- It can guide your financial decisions: Knowing your net worth can help guide your financial decisions, such as how much to save, how much debt to take on, and what types of investments to make.

How to Calculate Your Net Worth

Calculating your net worth is a relatively simple process, although it may take some time to gather all the necessary information. Here are the steps you can follow:

Step 1: Make a list of your assets

Start by making a list of everything you own that has monetary value, including:

- Cash and savings accounts

- Investments (such as stocks, bonds, and mutual funds)

- Retirement/ pension accounts (SIPP’s, SSAS’s etc)

- Real estate (including your primary residence, rental properties, and land)

- Vehicles (such as cars, boats, and motorcycles)

Other assets (such as jewelry, collectibles, and artwork)

For each asset, write down its estimated value.

Step 2: Make a list of your liabilities

Next, make a list of all your debts and other financial obligations, including:

- Mortgages

- Home equity loans or lines of credit

- Car loans

- Student loans

- Credit card balances

- Personal loans

- Other debts

For each liability, write down its outstanding balance.

Step 3: Calculate your net worth

Once you have a list of all your assets and liabilities, you can calculate your net worth by subtracting your liabilities from your assets. The formula for calculating net worth is:

Net worth = Assets – Liabilities

Let’s walk through an example of calculating net worth. For this example, let’s say your assets are as follows:

Cash: £10,000

Investments: £50,000

Pension accounts: £10,000

Home value: £300,000

Car value: £20,000

Personal property investments: £5,000

Total assets: £485,000

Next, list all of your liabilities, which are debts or obligations that you owe.

Let’s say your liabilities are as follows:

Mortgage: £200,000

Car loan: £10,000

Student loans: £30,000

Credit card debt: £5,000

Total liabilities: £245,000

Calculate net worth: To calculate net worth, subtract your total liabilities from your total assets. In this example, the individual’s net worth would be:

£485,000 (total assets) – £245,000 (total liabilities) = £240,000 (net worth)

So your net worth, in this example, is £240,000.

What if your net worth is negative?

Having a negative net worth means that your liabilities exceed your assets. In other words, you owe more than you own. This can happen for a variety of reasons, such as taking on too much debt, not saving enough, or experiencing a financial setback like a job loss or medical emergency.

Having a negative net worth can be concerning because it means that you may have trouble paying off your debts and achieving your financial goals. It can also impact your ability to qualify for loans, credit cards, or other financial products.

If you have a negative net worth, it’s important to take steps to improve your financial situation. This may include creating a budget to track your expenses and identify areas where you can cut back, increasing your income through a side job or negotiating a raise, and paying down your debts as much as possible.

In some cases, it may also be necessary to seek the assistance of a financial advisor or credit counselor. They can help you develop a plan to improve your financial situation, manage your debts, and build your net worth over time.

Remember, even if you have a negative net worth now, it doesn’t have to stay that way. By taking steps to improve your finances and sticking to a plan, you can work towards achieving a positive net worth and greater financial security in the future.

What if your net worth is positive?

Having a positive net worth means that your assets are worth more than your liabilities. In other words, you own more than you owe. This is a desirable financial position to be in, as it indicates that you have built up some financial resources that can be used to achieve your financial goals and provide greater financial security.

Your net worth is an important measure of your overall financial health, and a positive net worth is a good indicator that you are managing your finances well. It means that you have accumulated assets over time, such as investments, real estate, or other valuable possessions, while also managing your debts responsibly.

A positive net worth can also provide a greater sense of financial freedom, as you have the ability to access your assets and use them to achieve your financial goals. For example, you may be able to use your savings to purchase a home, pay for your children’s education, or retire comfortably.

It’s important to note that having a positive net worth is not a guarantee of financial success, and it’s important to continue managing your finances responsibly to maintain and grow your net worth over time. This may include continuing to save, invest, and manage debt wisely, while also regularly monitoring your net worth and making adjustments as needed to achieve your financial goals.

Tips for Improving Your Net Worth

If your net worth isn’t where you want it to be, don’t despair. There are several steps you can take to improve it over time, including:

- Invest in appreciating assets: Certain types of assets tend to appreciate in value over time, such as real estate and stocks. By investing in these types of assets, you can potentially increase your net worth as their value grows. However, with all investments your capital is at risk and you may get back less than you put in.

- Maximize your retirement contributions: Contributing the maximum amount allowed to pensions, can help grow your net worth over time. These accounts often offer tax advantages and potential investment growth, allowing your assets to accumulate faster than they would in a standard savings account. But you do need to consider whether you could make higher returns elsewhere. If so, maximising your pension accounts might not be the right thing at a particular point in time.

- Increase your income: Earning more money can help increase your net worth by allowing you to save more, invest more, or pay off debt faster. Consider asking for a raise at work, taking on a side hustle, or investing in your education to increase your earning potential.

- Reduce your expenses: By reducing your expenses, you can free up more money to pay down debt, save, or invest. Look for ways to cut back on unnecessary expenses, such as eating out less, canceling subscriptions you don’t use, or shopping for deals.

- Stay on top of your credit: Your credit score can impact your ability to borrow money and the interest rates you’re offered. By staying on top of your credit and paying bills on time, you can potentially improve your credit score and qualify for better rates on loans, reducing your overall debt and increasing your net worth.

- Pay down high-interest debt: High-interest debt, such as credit card balances and personal loans, can eat away at your net worth. Focus on paying off your debts as quickly as possible to reduce your liabilities and increase your net worth.

Which of the above tips could you start taking action on right now?

It’s worth noting that increasing your net worth takes time and effort. Don’t get discouraged if your progress is slow at first. By focusing on the steps that work best for your financial situation, and consistently working towards your financial goals, you can increase your net worth and achieve greater financial security over time. If your net worth is currently negative, you should not be investing yet and should instead be looking to address your debt situation first.

Propelle does not provide investment advice. If you are unsure about anything, please seek financial advice from an authorised advisor. Your capital is at risk.