23rd October 2023

Why inflation is so high, how it affects women and what we can do about it

Introduction

Inflation, like an invisible force, touches every aspect of our lives. From groceries to healthcare, the cost of living seems to be perpetually on the rise and all that anyone can talk about. Meanwhile, our income stays the same or doesn’t increase proportionately, eating up into our disposable income.

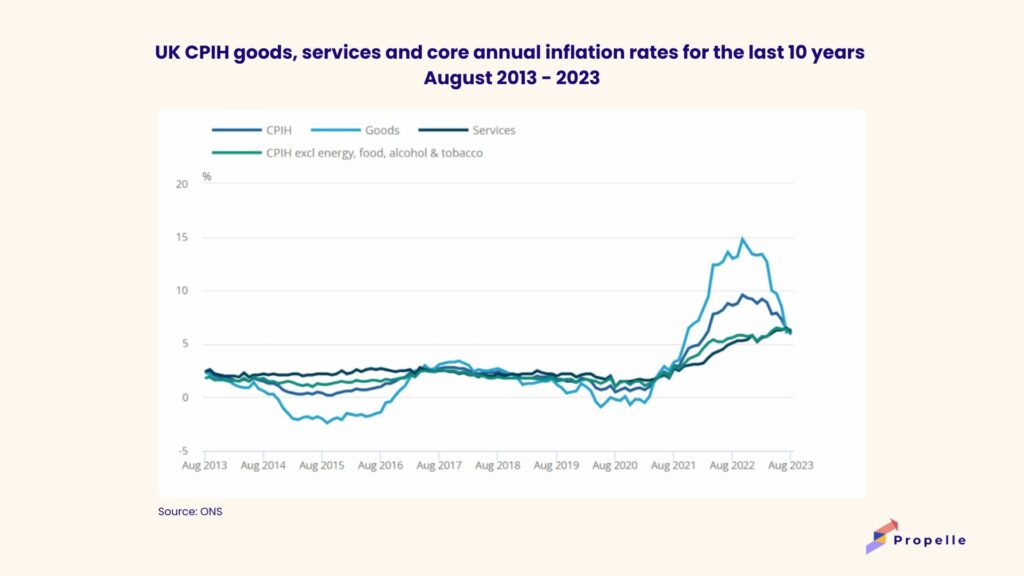

The target inflation rate in the UK is 2%. This means that every year, we expect the price of things to rise by 2%. However, this hasn’t been the case post-pandemic and in October 2022, inflation rose to a shocking rate of 11.1% – over 5 times the rate of inflation target.

Whilst it has come down to the upper end of 6’s (6.7% at the time this article was written in October 2023), the financial impact it has had has been challenging for many demographics, including women.

In this article, we’ll explore the reasons behind why inflation is so high, how it uniquely affects women and what we can do to mitigate the impact.

First, what is inflation?

To understand why inflation is so high at the moment, it’s important to understand how inflation works.

Inflation refers to the general increase in the prices of goods and services, resulting in a decrease in the purchasing power of our money. When inflation is high, each pound in our purse buys less than it used to. However, inflation isn’t necessarily a bad thing either.

The UK’s inflation rate target is 2% which is a target set by the Bank of England. When inflation aligns with the target, it indicates economic growth (people and businesses are spending money), it can prevent deflation (people and business are not spending money), it’s easier to adjust for wage growth (employers can keep up with a 2% inflation rate vs a 11.1% inflation rate), and it’s easier to manage debt (it becomes easier for borrowers to repay their loans with money that is less valuable than when they initially borrowed it). The last point is particularly relevant for governments with substantial public debt and individuals with mortgages and loans.

While inflation may appear to erode our purchasing power at first glance, it also plays a pivotal role in maintaining a healthy, growing economy.

Why inflation is so high

There are several factors impacting the rate of inflation at the moment, but the key ones are:

Supply chain disruptions: The COVID-19 pandemic disrupted global supply chains, causing shortages of essential goods and raw materials. When demand outstrips supply, prices tend to rise. The war between Russia and Ukraine has also had a direct impact as they are both important producers of various commodities and raw materials, including grains and metals. Any disruptions in the production or transportation of these goods can lead to shortages and price increases, which affect the prices of various products worldwide.

Rise in energy prices: When energy prices surge, it leads to increased operational costs for businesses. These costs are often passed on to consumers in the form of higher prices for goods and services. This phenomenon, known as cost-push inflation, contributes to a general increase in the price level throughout the economy.

A good example of this is car insurance. If you have a vehicle, you may be experiencing very high car insurance premiums no matter your insurance history. But the real reason for the increase in premiums is that vehicle parts have increased in price, so should you have an accident, it would cost your insurance more. Your insurance firm is trying to mitigate a financial loss by passing on the anticipated costs to you, the consumer.

Government stimulus: To combat the economic fallout of the pandemic, governments worldwide injected large sums of money into the economy. This money was borrowed from institutions such as private financial firms or pension funds in the form of bonds (aka gilts in the UK). Of course, all money borrowed needs to be paid back and the sudden influx of cash increased demand, further contributing to inflation.

Now that you understand the main reasons contributing to why inflation is so high, let’s look at the impact it has on us as women.

How inflation impacts women

Inflation impacts everyone but there are certain sets of challenges that we as women face specially. It’s important to be aware of them in order to know what we can do to alleviate them.

Gender pay gap

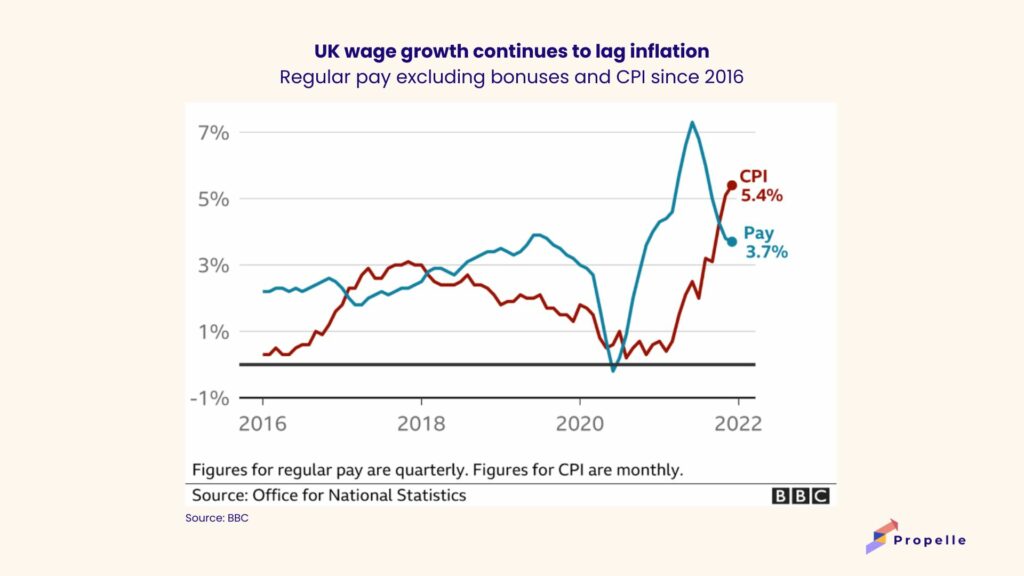

The existing gender pay gap compounds the issue of inflation. Women typically earn less than men (for every £100 a man earns, a woman earns approximately £85.10), so inflation affects us disproportionately, pushing our purchasing power even lower. If you are the parent or carer of someone, the impact could be more severe.

Purchasing power erosion

With the UK wage growth behind the current rate of inflation, women can find it harder to make ends meet as the prices of everyday goods and services rise faster than our pay. This can be particularly challenging for single mothers or women with limited financial resources. Women are also often the primary caregivers and budget managers in households. Rising prices place additional stress on managing household finances, which may already be stretched.

Lower retirement funds

High inflation erodes the real value of retirement savings and pensions, which can be detrimental to older women, who tend to live longer and may rely on these savings for a more extended period. It can also be tempting to pause paying into a pension to have more disposable income to spend or help make ends meet. However, in the long run, this could reduce the amount in your pension significantly. Of course, for some women temporarily pausing your pension contributions might be a necessity so consider contributing a large sum when you’re able to in the future to compensate.

So, what can women do when inflation is so high?

It’s not all doom and gloom ladies. Whilst inflation may be high, the good news is that a) it’s declining, and b) there are things we can do to mitigate the impact.

Budget wisely

Creating a well-structured budget that accounts for rising expenses can help us manage our finances more effectively. Check out this article on how to create your own personal finance budget.

Increase our financial literacy

Understanding how inflation works and how to invest wisely can empower us to grow our wealth over time. Like our good friend Oprah says, “Once you know better, you do better.” So, why not start now? We have a range of free courses, tailored to women, to get you started. All you need to do is sign up to the Propelle platform for free!

Negotiate for equal pay

Advocating for equal pay and better job opportunities is essential. As women, we should negotiate our salaries and advocate for pay equality in the workplace. Not sure how to do that? Check out our Money & Me course here.

Invest strategically

Ultimately, the best way to try and beat inflation is to invest. By investing, your money could potentially grow at the same or faster rate than inflation. This way, your money increases in value. When your money stays in a savings account for example, the value decreases.*

Let’s summarise

Let’s recap on what we’ve learnt in this article:

- Inflation refers to the general increase in the prices of goods and services

- The UK inflation rate target is 2%

- Inflation isn’t necessarily a bad thing as it indicates economic growth, prevents deflation and manages wages and debt

- Women can be impacted by inflation due to the gender pay gap, purchase power erosion and in the long-term, having less pension

- Supply chain disruptions, wars, a rise in energy prices and government stimulus’s contribute to higher inflation rates

- The best ways to beat inflation is to budget wisely, negotiate your pay and most importantly, invest so that your money can grow.

Ready to take action to mitigate the effects of inflation for you?

Check out our free courses here to help you get started on your wealth building journey today!

Disclaimer: Propelle does not provide investment advice. If you are unsure about anything, please seek financial advice from an authorised advisor. Your capital is at risk.